You can send your Required Minimum Distribution (RMD) to a charity using a strategy called a

Qualified Charitable Distribution (QCD). A QCD allows individuals aged 70½ or older to

donate up to $100,000 per year directly from their Individual Retirement Account (IRA) to a

qualified charity, without having to count the distribution as taxable income.

Here’s how to send your RMD to a charity:

can send your Required Minimum Distribution (RMD) to a charity using a strategy called a Qualified Charitable Distribution (QCD). A QCD allows individuals aged 70½ or older to donate up to $100,000 per year directly from their Individual Retirement Account (IRA) to a qualified charity, without having to count the distribution as taxable income.

Here’s how to send your RMD to a charity:

1. Ensure Eligibility

- You must be 70½ years old or older to use the QCD option.

- You can donate up to $100,000 per year from your IRA to one or more charities.

2. Choose a Qualified Charity

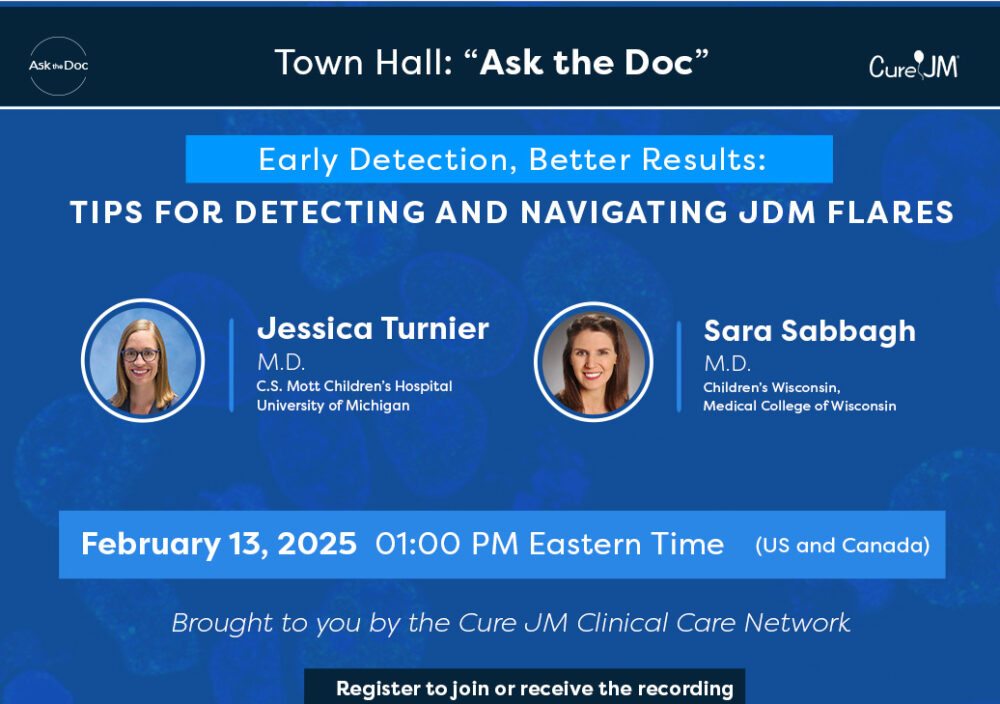

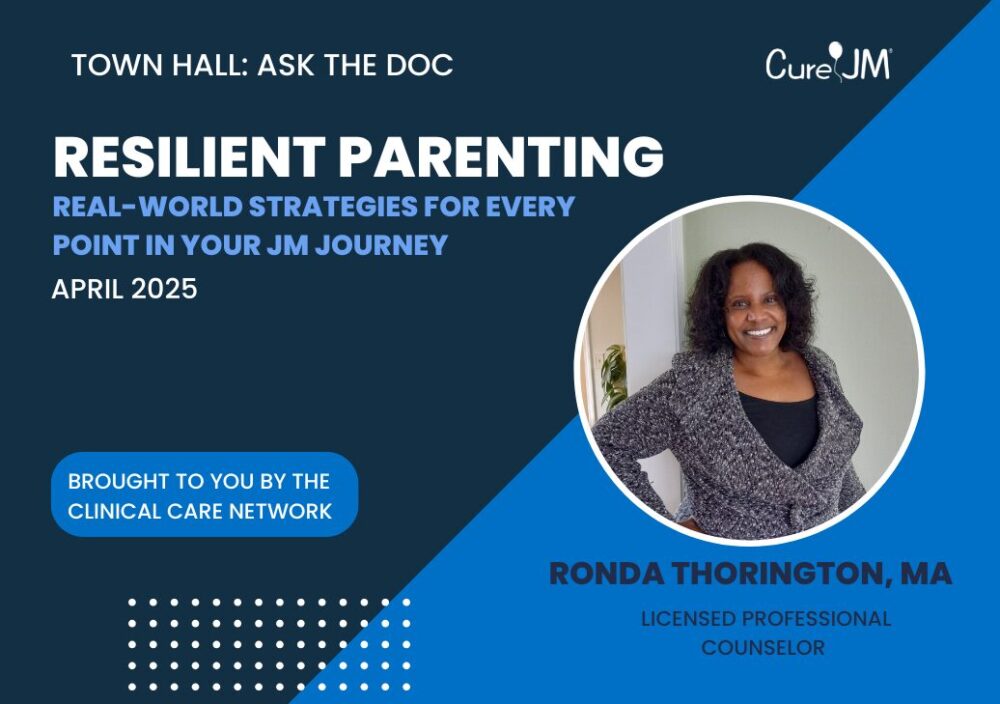

- Make sure the charity is a qualified 501(c)(3) organization such as Cure JM Foundation.

- Contact our Director of Development, Shannon Malloy, at shannon.malloy@curejm.org. Shannon will call you and explain the process to you.

3. Contact Your IRA Custodian

- Reach out to your IRA custodian (the financial institution holding your IRA) and request a Qualified Charitable Distribution.

- Some custodians may have online forms, while others will require you to call and complete paperwork.

- Give this information to your IRA Custodian:

- Cure JM Foundation, IRS Tax ID 35-2222262.

- Address: 19309 Winmeade Drive, Suite 204, Leesburg, VA 20176

- Mailing Address for Checks: Checks can be made out to Cure JM and mailed directly to the bank at Cure JM, P.O. Box 45768, Baltimore, MD 21297.

- Contact Information: Shannon Malloy, shannon.malloy@curejm.org, 512-709-1905

4. Direct the RMD to the Charity

- The IRA custodian will send the money directly to the charity. The distribution must go directly from your IRA to the charity to qualify as a QCD and avoid being included in your taxable income.

- You can request that the custodian send the charity a check, or in some cases, they can make an electronic transfer.

5. Retain Records

- Keep records of the QCD for tax purposes, including any letters or receipts from the charity acknowledging the donation.

- You won’t receive a charitable deduction for this contribution, but the donation amount will be excluded from your taxable income.

6. Report the QCD on Your Tax Return

- You will still receive a Form 1099-R from your IRA custodian showing the distribution.

- When filing taxes, report the distribution but indicate that the portion transferred as a QCD is nontaxable. Your tax preparer or software can help handle this correctly.

By using a QCD, you can fulfill your RMD requirement while also supporting a cause you care about, without the added tax burden of withdrawing the funds first.